Financing the Transition: Islamic Sustainable Finance in the Middle East and GCC Countries

Part 2 of our 3-part series on Sustainable Finance.

a. Islamic Finance and its Link to Sustainability

Islamic finance is founded on principles of fairness, ethical investing, and social welfare, which naturally align with the goals of sustainable development. Prohibiting interest (riba) and speculative activities (gharar), Islamic finance promotes risk-sharing, social justice, and investment in tangible assets, making it well-suited for sustainable finance initiatives. The concept of Maqasid al-Shariah (objectives of Islamic law) emphasises safeguarding life, wealth, and dignity, which resonates with environmental and social responsibility.

The increasing intersection between Islamic finance and sustainability has led to innovative financial products, particularly in the Middle East and GCC, where green sukuks and other instruments play a pivotal role in advancing the region’s climate transition strategies.

b. Islamic Sustainable Finance: Facts and Figures

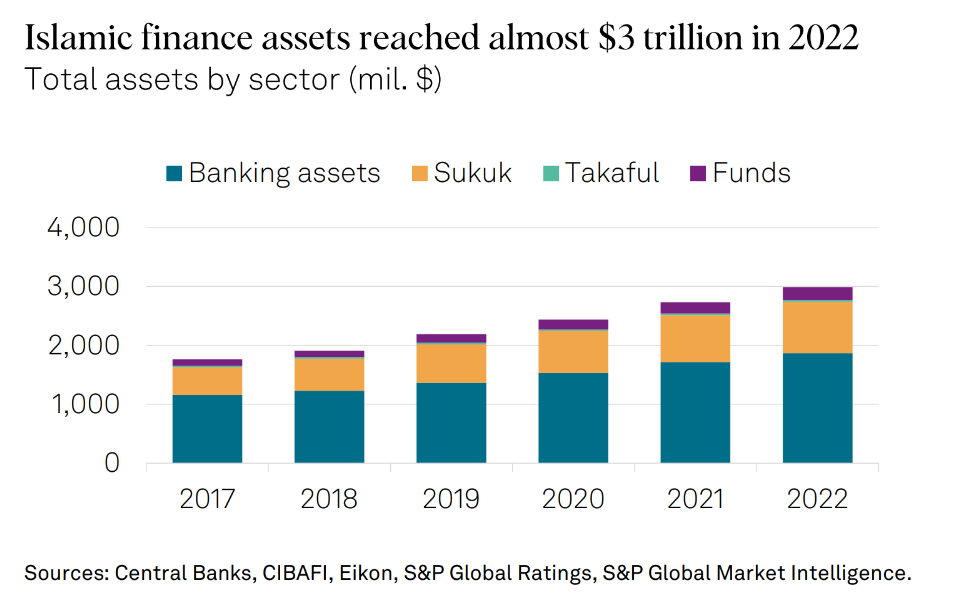

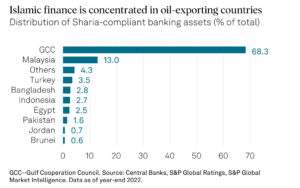

Islamic finance is gaining traction globally, driven by ethical investing trends and sustainable development goals. According to PwC, there is an increasing demand for sustainable sukuks from both issuers and investors, aligning with Islamic finance’s focus on ethical and socially responsible investments. Globally, the Islamic finance industry grew by 9.4% in 2022, reaching almost $3 trillion in assets, with the GCC contributing about 68% of these assets. This growth trend is expected to continue into 2024, driven by the implementation of economic diversification plans such as Saudi Arabia’s Vision 2030.

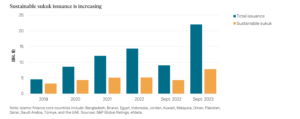

In 2023, sustainable finance issuance in core Islamic finance countries, including the GCC, reached $22.1 billion by the end of September, a significant increase from $9.1 billion in 2022. The rise in sustainable sukuk issuances indicates the growing importance of Islamic finance in supporting global sustainability objectives.

Islamic finance naturally aligns with the UN Sustainable Development Goals (SDGs), emphasising social equity and environmental stewardship. According to IFAC, Islamic finance offers risk-sharing and ethical investment options, which align closely with global sustainability efforts. Blended finance, combining Islamic finance principles with conventional methods, is highlighted as a solution to bridge funding gaps for sustainable development projects, further boosting Islamic sustainable finance’s growth.

c. The Sukuks, an Islamic Sustainable Finance Tool

Sukuks, or Islamic bonds, stand at the forefront of Islamic sustainable finance. Structured in compliance with Sharia law, sukuks represent ownership in a tangible asset, project, or investment and prohibit the accrual of interest. The issuance of green sukuks has become a key tool for financing projects that address environmental and social challenges, including renewable energy, water management, and affordable housing.

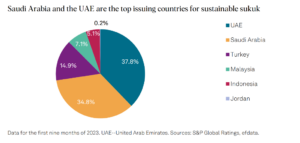

Globally, the sustainable bond market surpassed $1 trillion in 2021, and sukuks have increasingly contributed to this growth. In the Middle East, the issuance of sustainable sukuks rose significantly in 2023, with Saudi Arabia and the UAE accounting for over 70% of global sustainable sukuk issuances.

The standards for issuing these bonds and sukuks are defined by the International Capital Market Association (ICMA) and the Loan Market Association (LMA). The ICMA Green Bond Principles, for example, outline the use of proceeds, evaluation, and impact reporting, providing a framework that aligns with Sharia principles. The Islamic Development Bank’s (IsDB) sustainable finance framework is an example of applying these standards to ensure that sukuks support green and social projects in member countries.

Sukuks function differently from conventional bonds as they are asset-backed, with profits derived from the tangible assets or projects they finance. In sustainable finance, green sukuks are structured to fund environmentally friendly projects, such as renewable energy, waste management, and infrastructure. The profit-sharing mechanism embedded in sukuks aligns with Sharia principles, fostering transparency and risk-sharing. Additionally, proceeds from sukuks must be strictly allocated and reported in line with the ICMA Green Bond Principles, ensuring that funds are utilized to maximise social and environmental impact.

Green sukuks are structured in compliance with both Sharia and sustainability principles. These instruments offer flexibility, allowing for a wide range of funding options like renewable energy, sustainable infrastructure, and social impact projects. According to Global Ethical Finance, this flexibility, combined with asset-backing requirements, makes sukuks an ideal tool for driving impactful investments in the region. However, the complexity of sukuk structuring can pose challenges; harmonisation of standards and frameworks is key to streamlining their issuance, as noted by Environmental Finance.

d. Challenges and Opportunities in Islamic Sustainable Finance

Despite its growth, Islamic sustainable finance faces challenges. The complexity of structuring sukuks, along with variations in Sharia interpretations, can hinder their issuance. Scholars and standard-setters are pushing for more profit-and-loss sharing in sukuk structures, which, while enhancing social equity, could alter the financial viability of projects by increasing financing costs

However, digitalisation offers an opportunity to streamline the sukuk issuance process, reducing time and complexity. Harmonisation of standards and increased global awareness of Islamic finance’s potential in supporting climate transition could further attract issuers and investors.

e. Conclusion: The Path Forward

The growth of Islamic sustainable finance, particularly in the GCC, reflects the region’s commitment to integrating sustainability into its economic transition. Sukuks, supported by ICMA and LMA principles, are playing a pivotal role in financing projects aligned with national sustainability goals. However, addressing complexities and harmonising standards will be crucial to unlocking the full potential of Islamic finance in the global sustainability landscape.

At Sustainable Square, we specialise in helping organisations develop and implement sustainable finance frameworks aligned with ICMA and LMA principles. Whether you’re looking to issue green bonds, sustainability-linked sukuks, or navigate ESG integration in your financial strategy, we provide expert guidance to ensure compliance and long-term sustainability.

Reach out to us at info@sustainablesquare.com for consultation and support in driving your sustainable finance initiatives forward.