Navigating the ESG Frontier: A Regional Business Development Manager's Guiding Hand for New GCC Companies on Their IPO Journey

Crafting a customised ESG roadmap is a refined process, one that requires alignment with industry dynamics and adherence to evolving regulatory requirements specific to the GCC region.

GCC is experiencing a surge in companies aspiring to go public or those recently listed, marking a transformative phase in their corporate journey. As a regional business development manager in a consultancy firm specialising in ESG and sustainability, my role becomes a pivotal guide for new companies entering the stock market, ensuring that their IPO journey seamlessly incorporates the crucial elements of ESG.

In the intricate landscape of GCC IPOs, the decision to go public comes with elevated scrutiny, particularly in ESG considerations. Investors and regulators are increasingly emphasising these factors, necessitating a clear roadmap for companies venturing into the stock market. My role involves conducting a comprehensive ESG assessment, delving into existing practices, identifying gaps, and understanding the unique challenges and opportunities prevalent in the GCC context.

Crafting a customised ESG roadmap is a refined process, one that requires alignment with industry dynamics and adherence to evolving regulatory requirements specific to the GCC region. The goal is to develop a realistic and achievable plan that seamlessly integrates with the company’s overarching goals and ensures a successful IPO journey.

A key aspect of this journey is stakeholder engagement and materiality identification process. I always advocate for companies to commence with this crucial step. By gaining a deep understanding of their material topics through robust stakeholder engagement and materiality, companies can identify the right ESG priorities. This approach not only enables companies to tailor their sustainability efforts effectively but also provides a valuable benchmarking opportunity. Comparing material topics with industry peers allows companies to refine their focus, ensuring alignment with both regulatory expectations and industry best practices.

Education plays a foundational role in this transformative process. My approach is practical, focusing on advising and facilitating educational programs for leadership and employees. The goal is to ensure that every individual not only grasps the significance of ESG but is also empowered to actively contribute to the company’s sustainability efforts. It’s about genuinely embedding ESG principles into the DNA of the organisational culture.

Navigating the evolving regulatory landscape is a constant challenge, particularly for new entrants. My role involves staying ahead of regulatory changes, ensuring that the company’s practices align with current and future ESG requirements, thereby mitigating compliance risks and fostering a culture of proactive adaptation.

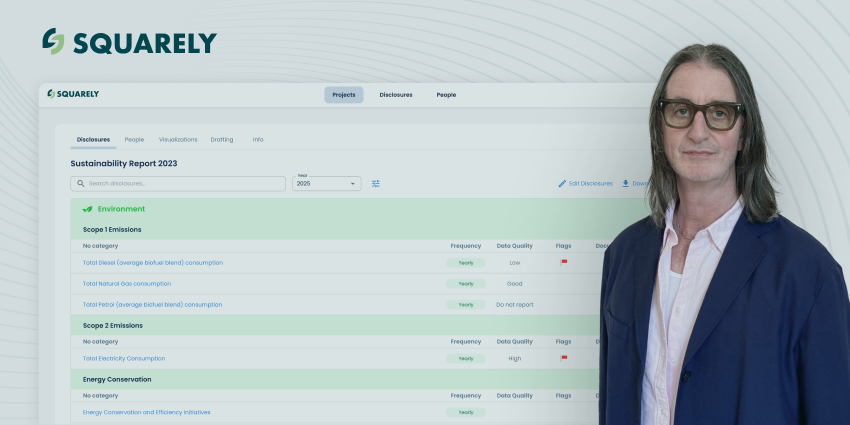

Transparent ESG disclosure is the key to a successful IPO. I guide companies in developing reports that meet global standards while resonating with investors, fostering transparency that builds credibility and nurtures positive relationships with stakeholders.

I identify ESG-related risks and provide support to help them understand the importance of developing mitigation strategies. This process enhances resilience and safeguards the company’s reputation.

In ensuring a smooth ESG transition, my goal extends beyond compliance—it’s about making ESG an intrinsic part of their DNA. The operations of these companies are not just aligned with regulatory requirements; they embody a commitment to sustainability and responsible business practices. It’s a journey where financial success harmonises with ESG excellence, creating a blueprint for a sustainable future in the dynamic landscape of GCC business.

In conclusion, navigating the GCC market successfully necessitates the precise integration of ESG principles, ensuring a smooth path to public listing. As your dedicated guide, I am here to empower your company in this transformative process.

If your organisation is gearing up for an IPO or considering going public, I invite you to leverage our expertise and collaborative approach. Let us navigate the intricacies of the GCC market together.

Take the first step towards a successful journey with a strong ESG foundation – contact us today.