HOW THE SINGAPORE EXCHANGE HELPS CATALYSE THE SUSTAINABILITY JOURNEY OF ITS LISTED COMPANIES

Stock exchanges, with their pivotal position in the financial ecosystem and their ability to influence huge number of listed companies, are well-placed to provide a powerful boost to sustainability. Within the Association of Southeast Asian Nations, the Singapore Exchange (SGX), together with Bursa Malaysia, has become the second stock exchange in ASEAN that mandates sustainability reporting.

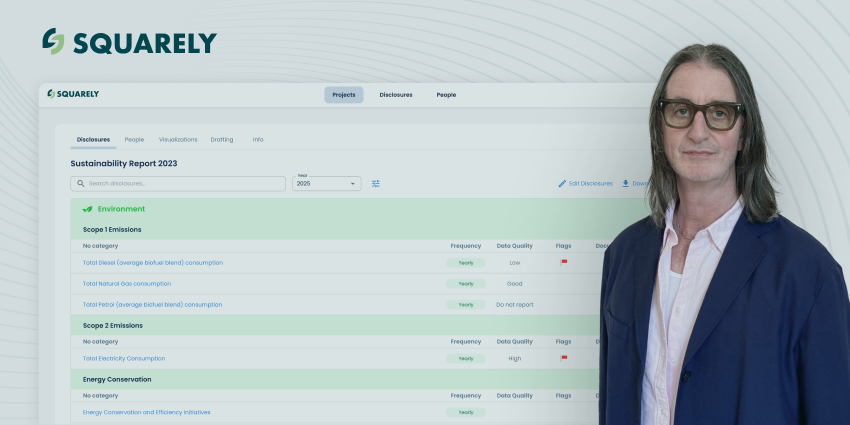

Sustainable Square carried out an interview with Michael Tang – Head of Listing Policy and Product Admission at SGX to discuss the motivations for SGX to implement sustainability initiatives, the challenges it has faced and the lessons that can be shared with other stock exchanges. Michael is the head of Listing Policy & Product Admission at Singapore Exchange (SGX). He oversees listing policy and rules development and has oversight of the listing admission of non-equity products, including debt securities, structured products and exchange-traded funds. Michael leads SGX’s efforts to promote sustainability across stakeholder groups, and was a judge for the Singapore Sustainability Reporting Awards organised by the Singapore Institute of Directors. Since joining SGX as a management associate, Michael has served in roles within regulatory policy and issuer regulation and as legal counsel. Michael graduated from the National University of Singapore with a Bachelor of Laws degree and is admitted to the Singapore bar.

What are the motivations for the SGX to implement this initiative?

This initiative is the result of rigorous consultation with various stakeholders such as our listed companies, investors, financial institutions; and advisory firms. For example, our survey of institutional investors in 2015 found that over 90% of respondents consider ESG factors when investing. We realise that long-term investors are now looking beyond financial metrics of success, and are considering sustainability and the environmental, social and governance (ESG) factors of their investments. This is a critical incentive for companies to start disclosing their ESG information and report on their policies, practices, performance and targets for each.

Meanwhile, we have some listed companies that are not only leaders in their industry, but also champions of sustainability practices. We believe their commitment to sustainability in business will inspire other companies to join the movement.

From our perspective, we believe that managing material sustainability issues have long-term impacts on the viability of a business, which in turn has a knock-on effect on the market and the stock exchange.

We believe once the values and urgency of adopting well reported sustainability practices is appreciated, everything else will start falling into place.

Each stock exchange may face different challenges when implementing their sustainability initiatives. What is the business case for SGX?

Companies are at various stages on their sustainability journey. For example, some companies have been publishing sustainability reports for a long time while many are still trying to understand what sustainability means in the context of their business. As a result, we have conducted a thorough stakeholder engagement process considering different research methodologies, finding out how to get the most relevant information from companies in the most efficient manner.

Getting senior management to buy in plays a pivotal role in driving any sustainability agenda, something that is not always an easy task. We emphasise sustainability from a business perspective in many of our workshops, seminars and conferences targeting top management teams. We believe once the values and urgency of adopting well reported sustainability practices is appreciated, everything else will start falling into place.

How does this mandatory sustainability reporting fit into the bigger plan of SGX to promote sustainability practices to listed-companies?

Besides our role as a regulator in the financial market, we are also developing the market. We consistently raise awareness about sustainability topics and promote regional and global sharing. For example, as 2018 is the Year of Climate Action in Singapore, we partnered with Task Force on Climate-related Financial Disclosure (TCFD) and organised a conference in March, discussing how investors and financial markets can assess and manage climate risks.

By the end of this year, we will assess the sustainability reports of our listed companies. Several things that we are eager to know are: material sustainability factors the companies are facing, sustainability policies they have in place, indicators that are material but missing and; the challenges that companies are currently facing. This data will help us tailor our support for companies and define the next steps.

What are some of the lessons you can share with other stock exchanges that are attempting to implement sustainability initiatives?

Every market needs to create an individual approach suitable to their circumstances, and we are just approaching our first reporting milestone on this. I think our project benefited from a comprehensive engagement with stakeholders. We consulted broadly with the people who are interested in, and who will be affected by what we want to do. Indeed, the information gathered from surveys and dialogues with different parties has already helped us catalyse the sustainability journey of our listed companies.

I believe communication also plays a vital role, especially when introducing any new policies and guidelines. It is necessary to emphasise the “why”; the benefits of the new practice, in order to get consensus from the business.