Unveiling the Surge - Exploring the Growing Emphasis on ESG Reporting in India

According to a recent study conducted by the renowned Indian Institute for Sustainable Development (IISD), Indian companies that effectively manage their ESG risks have reported a 25% increase in profitability over the past three years.

Sustainability has emerged as a critical consideration for businesses worldwide, and India is no exception. In recent years, there has been a remarkable surge in the emphasis placed on Environmental, Social, and Governance (ESG) reporting within the Indian corporate landscape. This article aims to delve into the trends, developments, and opportunities surrounding this growing phenomenon, shedding light on its significance for businesses operating in India.

ESG reporting encompasses the measurement and disclosure of a company’s performance in key areas related to environmental impact, social responsibility, and corporate governance. It provides stakeholders with valuable information about a company’s commitment to sustainable practices and responsible business conduct. While ESG reporting has been gaining traction globally, India has witnessed a notable acceleration in its adoption.

Factors Driving the ESG Surge

India’s national conversation on sustainable development is the backdrop of the uptake of ESG reporting in the corporate world. In India’s Long-term, Low-carbon Development Strategy, the country has committed to reduce carbon emissions to less than 45% by 2030 and to be net zero by 2070.

One of the driving factors behind this surge is the increasing recognition of the interconnectedness between sustainability and long-term business success. Indian companies are realizing that integrating ESG considerations into their core strategies can unlock numerous benefits. For example, companies that prioritize ESG performance often experience improved operational efficiency, cost savings through resource optimization, and reduced regulatory risks.

Furthermore, proactive ESG reporting demonstrates a company’s commitment to transparency and stakeholder engagement, fostering trust and enhancing brand reputation. Tata Group, one of India’s leading conglomerates, has gained international recognition for its robust ESG reporting practices. By disclosing detailed metrics on carbon emissions, employee welfare initiatives, and board diversity, Tata Group has positioned itself as a responsible corporate citizen, attracting socially conscious investors and customers.

In line with the growing importance of ESG reporting, the Securities and Exchange Board of India (SEBI) has taken proactive measures to drive greater transparency and accountability. The SEBI mandate, effective from the financial year 2022-23, requires the top 1,000 listed companies in India to disclose their ESG performance. This regulatory move has acted as a catalyst, propelling companies to prioritize and enhance their ESG reporting practices. However, the recent Deloitte India’s ESG Preparedness Survey revealed that only 27% Indian organisations feel adequately equipped to meet their ESG (Environmental, Social and Governance) strategy and compliance requirements and only 15% believe their suppliers are ESG-ready.

The Modern Approach: Technological Advancement and Stakeholder Involvement

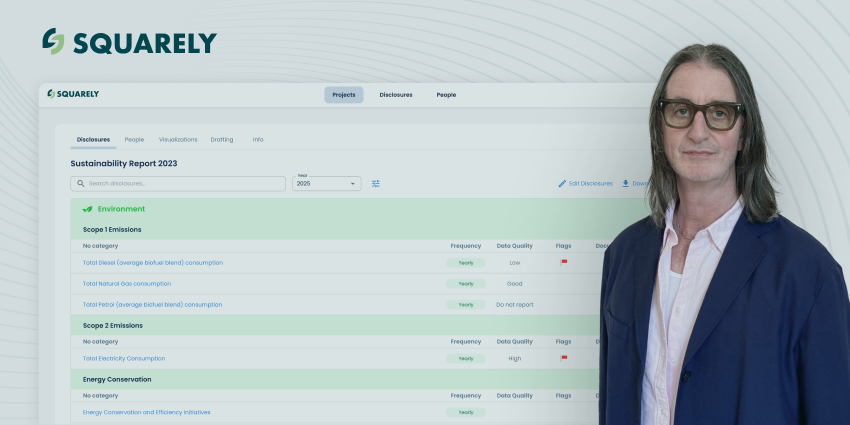

Examining recent developments in ESG reporting in India provides a deeper understanding of its significance. Companies are increasingly investing in robust data collection and management systems, leveraging technology to ensure accurate and reliable ESG disclosures. For instance, Infosys, a leading Indian IT services company, has implemented a data-driven approach to track and report on its ESG performance. Through the use of advanced analytics and automation, Infosys has improved the accuracy and timeliness of its ESG data, enabling informed decision-making and better risk management.

Moreover, Indian businesses are actively seeking engagement and feedback from stakeholders, including investors, customers, employees, and communities. This stakeholder-centric approach helps shape their sustainability strategies, ensuring alignment with societal needs and expectations. Companies like Hindustan Unilever Limited (HUL) have implemented extensive stakeholder consultation processes to identify material ESG issues. By conducting surveys, focus groups, and town hall meetings, HUL has gained valuable insights that have informed their ESG priorities and initiatives, leading to enhanced stakeholder satisfaction and long-term value creation.

The Road Ahead for ESG in India

It is important to note that while significant progress has been made in ESG reporting in India, there are areas for improvement. For instance, standardization of ESG metrics, particularly industry-specific ones, can enhance comparability and enable benchmarking. Collaborative efforts between industry associations, regulatory bodies, and reporting frameworks are essential in developing a common language for ESG reporting, facilitating meaningful comparisons and analysis. Additionally, capacity-building initiatives and knowledge-sharing platforms can support smaller companies in adopting ESG reporting practices effectively.

In conclusion, the surge in ESG reporting in India reflects the evolving mindset of businesses, recognizing the importance of sustainability as a core driver of long-term success. The SEBI mandate has acted as a catalyst, further propelling companies to embrace ESG reporting as a strategic imperative. By integrating ESG considerations into their operations, Indian businesses can unlock benefits such as improved operational efficiency, enhanced reputation, and access to responsible investment. As India progresses on its sustainability journey, ESG reporting will continue to be a vital tool for businesses to navigate the evolving landscape, meet stakeholder expectations, and contribute to a more sustainable and responsible future.