ESG Trends That Define 2022

Corporate boards and government officials will be under pressure to demonstrate their capacity to comprehend and monitor ESG concerns and integrate sustainability into their policy and planning initiatives…

In 2021, Environmental, Social and Governance (ESG) dominated corporate conversations and has continued well into 2022 without a sign of slowing down. Alongside climate, biodiversity and other environmental concerns, social issues (such as DEI and worker wellbeing) will remain in the spotlight, becoming increasingly intertwined with broader ESG discussions.

S&P’s insights provide a fair understanding of the key ESG trends that have been dominating the conversation in 2022. As S&P describes, ESG trends should not be considered in isolation but should be understood in relation to each other.

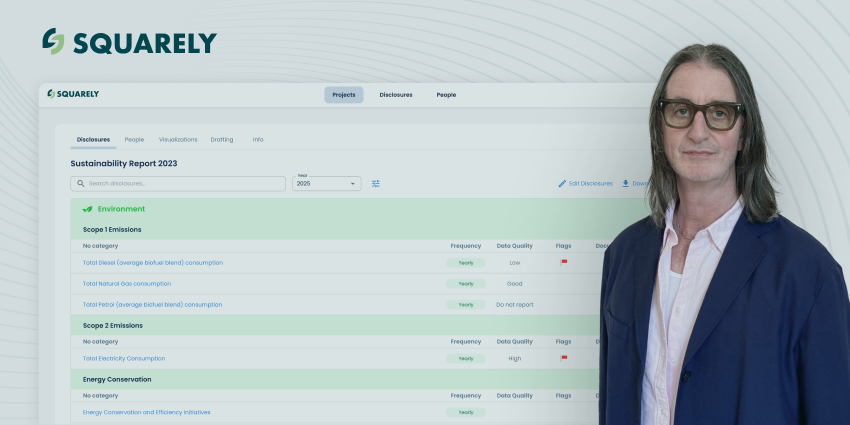

1. Demand for More Credible Disclosure

The term “greenwashing” has shown a dramatic rise in searches since 2020. It’s a term used to describe how businesses sell themselves in a way that makes them seem more eco-friendly, but in reality, their goods and services are not sustainable.

By 2022, increased transparency in reporting on company sustainability activities will be required by investors, authorities, and the general public. According to the International Sustainability Standards Board, the lack of a common understanding of disclosure standards across countries and industries is one of the major obstacles to accountability. As a result, new international ESG-related standards will continue to develop.

2. Increased Tension Over Divestment vs Engagement Debate

The divestment vs. engagement debate mainly revolves around the question of whether or not investors should cling to their investments in fossil fuel companies and exercise influence as shareholders. More substantial asset owners, managers, and banks will withdraw from their holdings in 2021 any companies with poor ESG policies or significant ESG risk exposure.

S&P anticipates that divestiture will increase in popularity in 2022, particularly as financial sector businesses work to develop investment and lending portfolios that are compliant with the Paris Agreement. Due to the fact that it does not promote change, this could result in more people doubting if divestment reduces carbon footprint (especially if those shares are sold to others who do not care as much about the environmental implications). Whatever the strategy, the fact is that lenders and investors will be required to justify their choices, which will make ESG measurement the focal point of the discussion.

3. Challenging Leadership to Become ESG-skilled

Increased shareholder activism in 2021 resulted in several votes against corporate directors for failing to present convincing action plans. This pattern will only spread more widely in 2022.

Corporate boards and government officials will be under pressure to demonstrate their capacity to comprehend and monitor ESG concerns and integrate sustainability into their policy and planning initiatives, from climate change to human rights and social unrest. Additionally, while building teams, DEI efforts will continue to change from a checked box to a holistic approach.

4. The March to Net Zero

A well-known climate study from the IPCC was published in 2021 and was termed “a code red for humanity” by the UN Secretary-General. And while though the number of governments and significant corporations stating targets to achieve net-zero emissions by 2050 increased quickly, these promises were sometimes ambiguous and lacked specific measures to reduce indirect emissions that happen across the supply chain.

Shareholders and other stakeholders will demand more in 2022 as a result of clear environmental pressure, pushing organizations to create immediate, actionable strategies and start addressing emissions across the whole value chain.

5. Combining Environment and Social Issues in Climate Strategies

It is impossible to talk about climate issues without addressing their connection to developing social issues. Inflation, higher energy costs, and tightened monetary policy. In 2022 the climate agenda must consider the social implications for the transition and ensure a sustainable approach that includes broader socioeconomic and geopolitical challenges. This will pose both challenges and opportunities for the global economy.

6. Climate Stress Testing in Financial Institutions

Financial institutions and policymakers are beginning to recognize the financial risks associated with the climate crisis and the role that financing can play in facilitating the low-carbon transition and ensuring the climate resiliency of the economy.

In 2022, more central banks will incorporate climate risk as a stress testing feature for banks and insurers. We will also see insurance regulators taking steps to integrate sustainability, and particularly climate risks, into their risk frameworks.

7. Increasing Importance of Assessing Natural and Biodiversity Risks

In recent years, we have seen governments and businesses make greater pledges to safeguard nature and biodiversity in their day-to-day activities. But according to S&P, corporates would have to deal with the difficulties of evaluating and managing natural and biodiversity risks throughout their supply chains by 2022. In order to do this, a few events and activities in 2022 will aid in facilitating discussions between countries to establish new targets for the protection of biodiversity as well as measurements, frameworks, and standards that will put biodiversity and natural commitments more in the spotlight.

8. More Attention to Social Issues in Supply Chains

As the global economy continues to recover from the pandemic in 2022, companies will continue to face supply chain challenges with costs and risks of disruption. At the same time, the pressure to address social issues that concern supply chains (such as human rights and labour conditions) will increase, thus pushing companies to evidence credible human rights and monitoring efforts up the chain.

9. The Integrity of the Growing Debt Market Will Be Tested

The overall sustainable debt increased by 61 percent from the previous year to a record high of around $960 billion in 2021. S&P predicts that growth will be able to continue in 2022 as businesses and governments look for ways to pay for the shift to a net-zero economy. As was previously mentioned, the difficulty will be to control this expansion so as it reaches new heights, the credibility and integrity of the financing instruments and the sustainable debt market are maintained.

In Conclusion

2022 is likely to be the year when the responsible investment sector moves out of the shadows, playing a more protagonist role. With this, rising demands for action will increase pressure for more accountability, greater regulatory scrutiny, and credible disclosure backed by better data.

But according to The World Economic Forum (WEF), 2022 offers hope for the global community. Through global collaboration, public-private partnerships, new models and innovations, and a renewed sense of social responsibility, we can create a more sustainable, inclusive and resilient world.