Part 1 of our 3-part series on Sustainable Finance.

Sustainable finance, defined as the integration of environmental, social, and governance (ESG) considerations into financial decisions, plays a critical role in addressing global challenges like climate change and social inequality. With ESG-focused investing becoming a significant trend, financial institutions worldwide are steering investments toward projects that contribute to environmental protection, social equity, and long-term governance stability. These include green, social, and sustainability-linked financial instruments.

Sustainable finance acts as a bridge between financial goals and sustainability outcomes, promoting long-term financial resilience while addressing pressing environmental and social challenges. The International Energy Agency estimates that nearly $4.5 trillion in annual investments will be required by 2030 to meet global climate targets, emphasizing the importance of mobilizing capital for sustainable projects.

Sustainable Finance in the Middle East and GCC countries

In the Middle East and GCC (Gulf Cooperation Council) countries, the transition toward sustainable finance is emerging as a key strategy for economic diversification and climate resilience. The sustainable finance sector is emerging as a vital driver of economic diversification, offering a significant opportunity. According to Strategy&, green finance in the GCC alone could unlock up to $2 trillion in cumulative GDP by 2030, creating over 1 million jobs. The primary sectors driving this opportunity include agriculture, construction, power, transport, water, and waste management.

This investment will not only help reduce the region’s dependency on hydrocarbons but also enhance its economic resilience and encourage foreign direct investment (FDI). Given the abundance of low-cost renewable energy, the GCC is well-positioned to leverage this opportunity.

GSSSB Bonds, Loans and Sukuks

Globally, sustainable bond issuance has been on a consistent rise, with sustainable bonds (green, social, and sustainability-linked) surpassing $1 trillion in 2021. Green bonds account for the largest share of this market, with significant contributions from social and sustainability-linked bonds.

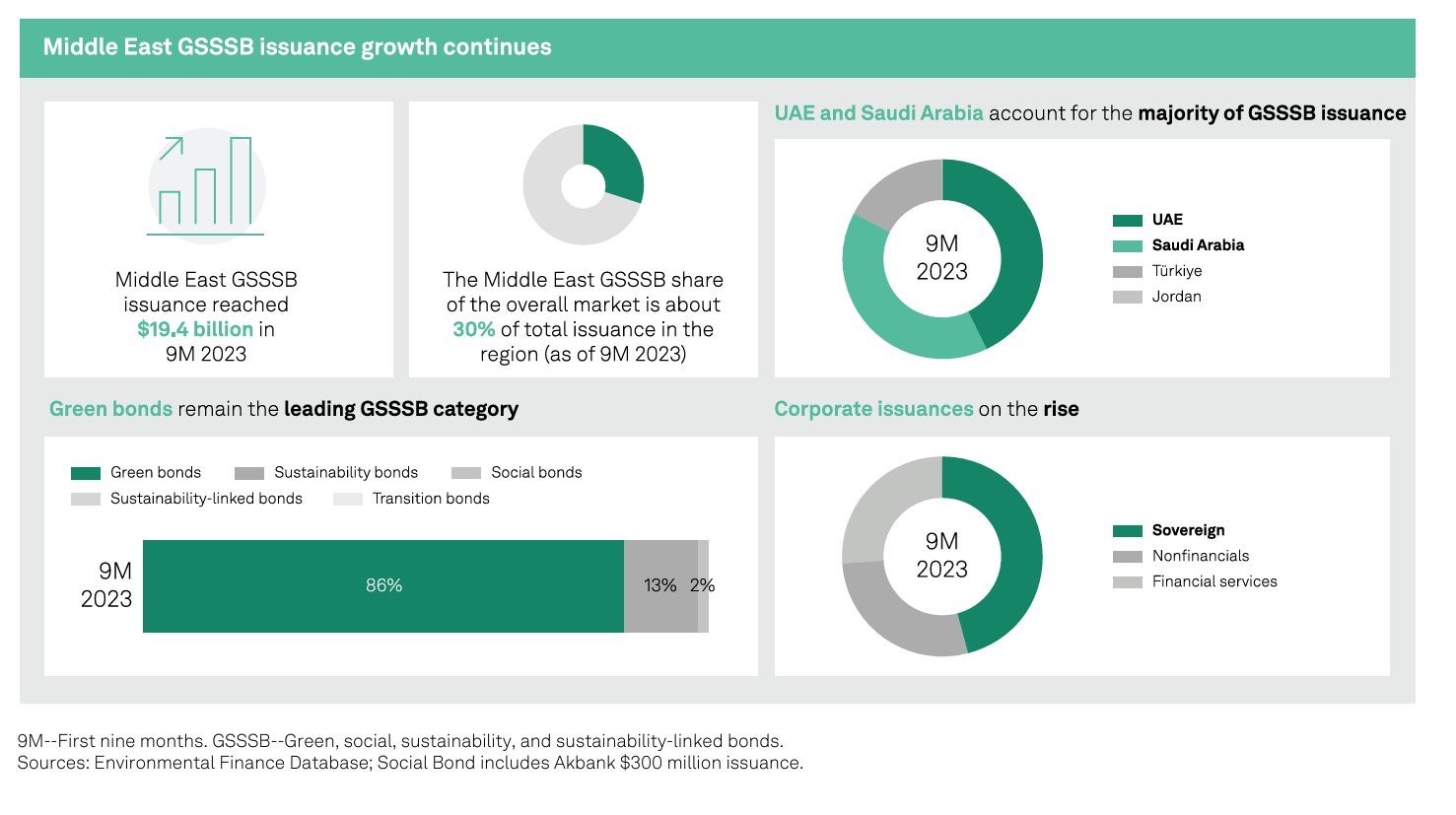

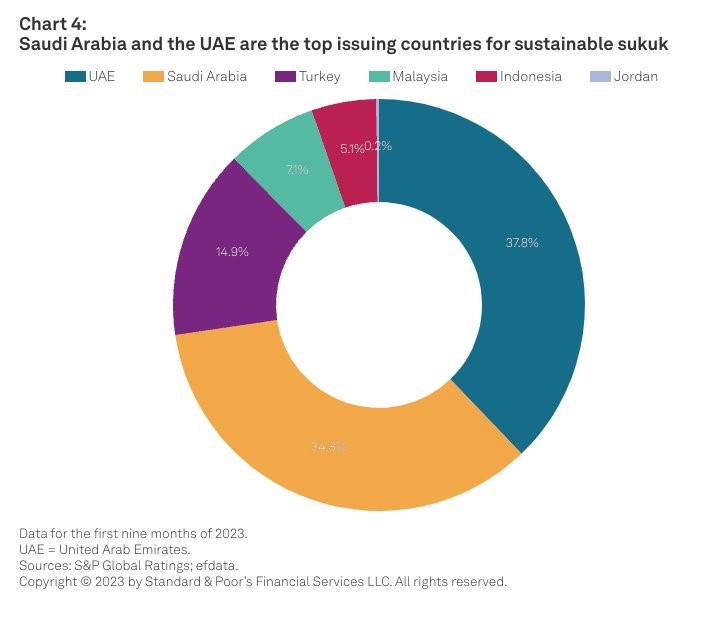

In the Middle East, the volume of sustainable finance issuance reached $19.4 billion by September 2023, compared to $9.1 billion in 2022. Saudi Arabia and the UAE account for over 82% of the sustainable issuance market in the Middle East, and for over 70% of sustainable sukuk issuances globally. The market for sukuks, which are Sharia-compliant financial certificates, continues to expand as regional governments commit to financing their energy transitions.

The principles for these bonds, loans, and sukuks are primarily defined by the International Capital Market Association (ICMA) and the Loan Market Association (LMA), ensuring that the funds raised are allocated transparently and toward eligible sustainability projects. These frameworks offer credibility, helping investors align with both Islamic and sustainable finance principles.

Governments’ Sustainable Finance Frameworks

Governments across the GCC have developed comprehensive sustainable finance frameworks to support national and regional climate goals. The UAE, for example, launched its Sustainable Finance Framework in 2021 to guide investments toward green and social projects. Oman also adopted a Sustainable Finance Framework in January 2024, aligned with its long-term sustainability goals, Oman Vision 2040.

Saudi Arabia introduced its Green Financing Framework in March 2024, aligning it with Vision 2030, demonstrating the country’s commitment to transitioning to a low-carbon economy. These frameworks ensure that financial instruments like green bonds and sukuks are used in compliance with sustainability principles, providing clarity and transparency for investors. The alignment with ICMA and LMA principles guarantees that the proceeds are directed toward eligible green projects, further supporting the region’s shift toward sustainability.

Conclusion

The Middle East and GCC countries are steadily advancing toward a future of sustainable finance, driven by government initiatives, corporate leadership, and increasing investor demand for ESG-compliant projects. The rise of GSSSBs and sukuks in the region highlights a clear commitment to integrating sustainability into financial systems. As these markets continue to evolve, they will play a critical role in financing the global transition to a low-carbon, socially inclusive economy.

By embracing sustainable finance, Middle Eastern nations are not only safeguarding their own economic future but also contributing to global climate goals, setting the stage for a resilient and sustainable future.

At Sustainable Square, we specialise in helping organisations develop and implement sustainable finance frameworks aligned with ICMA and LMA principles. Whether you’re looking to issue green bonds, sustainability-linked sukuks, or navigate ESG integration in your financial strategy, we provide expert guidance to ensure compliance and long-term sustainability.

Reach out to us at info@sustainablesquare.com for consultation and support in driving your sustainable finance initiatives forward.

In the next article of this series, we’ll dive deeper into sukuks and their expanding role within Islamic finance and sustainable finance. We’ll explore how sukuks, with their Sharia-compliant structure, offer a powerful tool for financing green projects while maintaining ethical investing principles. Stay tuned to learn more about how sukuks are helping to shape the future of sustainable finance in the Middle East and beyond!