Financing the Transition: Guide to Implementing a Sustainable Finance Framework

The final part in our 3-part series on Sustainable Finance.

In our previous articles, we explored the growth of sustainable finance in the Middle East and GCC, highlighting ESG investments and instruments like green bonds and sukuks. This third article serves as a practical guide to implementing a sustainable finance framework, from foundational steps for newcomers to advanced practices for those experienced in sustainable finance. This framework will support investments aligned with ESG goals, contributing to a more sustainable economy.

a. Foundations of a Sustainable Finance Framework

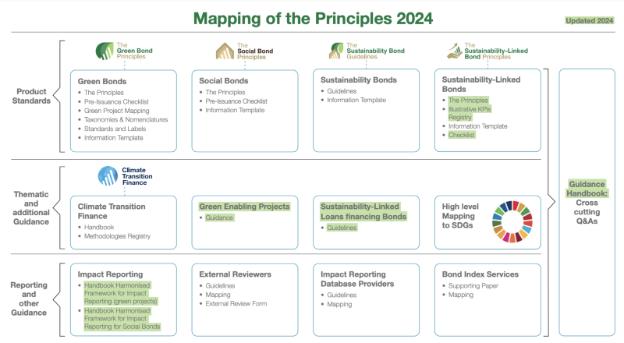

Implementing a sustainable finance framework starts with the established guidelines from the International Capital Market Association (ICMA) and Loan Market Association (LMA). These principles set standards for transparency, accountability, and alignment with sustainability goals.

For Green, Social, and Sustainability (GSS) Bonds or Loans, the first step is defining the Use of Proceeds. Organisations identify project categories—such as renewable energy or affordable housing—that will directly benefit from these funds, ensuring alignment with broader sustainability objectives.

The Process for Project Evaluation and Selection follows. This step involves evaluating projects against pre-defined sustainability criteria, ensuring only qualified projects receive financing. This rigorous selection strengthens accountability and signals a commitment to transparency and high standards.

Once projects are selected, organisations must ensure effective Management of Proceeds. Robust tracking mechanisms monitor the flow of funds, preventing misallocation and enabling timely adjustments. This tracking builds confidence among stakeholders and reinforces the credibility of the financial instrument.

Finally, Reporting is essential for transparency and accountability. Regular reporting keeps investors and regulators informed of fund allocations and project impacts. It reinforces stakeholder trust and ensures compliance with ICMA and LMA guidelines, establishing a culture of openness that benefits long-term investor relationships.

For Sustainability-Linked Instruments, the framework focuses on performance-based targets. The first step, Selection of Key Performance Indicators (KPIs), involves identifying metrics that reflect the organisation’s sustainability goals and areas of impact, ensuring they are relevant and measurable.

Next is the Calibration of Sustainability Performance Targets (SPTs). SPTs should be ambitious yet achievable, balancing industry benchmarks with internal capabilities. Realistic targets reinforce investor trust, demonstrating both ambition and feasibility.

In defining Bond or Loan Characteristics, the instrument’s financial terms are tied to the achievement (or non-achievement) of SPTs. This alignment embeds accountability within the financial structure, linking returns to progress on sustainability goals.

Reporting is equally essential here, offering transparency on KPI progress and enabling stakeholders to track performance. Last is Verification by an external third party provides credibility, with an unbiased assessment of the organisation’s achievements.

b. Types of Sustainable Finance Instruments

A sustainable finance framework often incorporates three types of instruments: Green, Social, and Sustainability-Linked. Each serves a distinct purpose, with unique eligibility criteria.

Green Bonds/Loans fund projects specifically focused on environmental benefits. Eligible projects typically include renewable energy, energy efficiency, pollution prevention, biodiversity preservation, sustainable water management, climate adaptation, and green building initiatives. These projects aim to reduce environmental impact and foster resource conservation. Noor Abu Dhabi is an example of a green project financed through the issuance of a green bond. The project is one of the world’s largest solar power plants which generates approximately 1.2 GW of solar energy, reducing CO₂ emissions by nearly one million metric tons annually—equivalent to removing 200,000 cars from the road.

Social Bonds/Loans finance projects with direct social benefits, focusing on underserved or vulnerable populations. Eligible initiatives include affordable infrastructure (e.g., water, sanitation, clean energy), essential services (e.g., healthcare, education), affordable housing, food security, and socioeconomic empowerment programmes. Social instruments drive positive societal change through improved access and opportunity. For example, The IFC committed, through its Social Bond programme, to lend $5 millions to Vitas Palestine, a microfinance company operating in West Bank & Gaza. The company serves MSMEs and individual borrowers by providing several lending products including business loans, housing loans and consumption loans. The project will provide financing to SMEs and WSMEs.

Sustainability-Linked Instruments differ from green and social bonds in that they link financial terms to the issuer’s achievement of specific sustainability goals. Sustainability-Linked Loans (SLLs) adjust economic characteristics based on the borrower’s performance against measurable sustainability objectives. Similarly, Sustainability-Linked Bonds (SLBs) adjust their financial or structural terms based on predefined ESG targets. Unlike green or social bonds, these are forward-looking, performance-based tools that incentivise continuous sustainability improvements. Bapco launched in 2023 a Sustainability-Linked Finance Framework, to issue a Sustainability-Linked Bond, supporting oil and gas projects, which would be excluded in GSS bonds, by adopting sustainable goals and KPIs.

c. Advanced Recommendations for Experienced Practitioners

Organisations experienced in sustainable finance can deepen their frameworks with advanced strategies to drive greater impact.

Integration of Digital Solutions: Leveraging digital technologies like blockchain and AI can enhance reporting accuracy and real-time tracking of sustainability metrics, which simplifies compliance and strengthens investor confidence. Automated processes also reduce operational costs, promoting efficiency.

Advanced Impact Measurement: Experienced organisations benefit from outcome-based reporting. Beyond project-specific impacts, they can assess broader societal and environmental changes through tools like Social Return on Investment (SROI). This level of impact measurement deepens accountability and adds value for investors seeking measurable results.

Dynamic Frameworks: Sustainable finance frameworks should adapt to shifting regulations, market expectations, and evolving sustainability goals. Organisations can establish mechanisms to recalibrate KPIs and SPTs as needed, maintaining relevance and aligning with long-term sustainability priorities.

Stakeholder Engagement and Transparency: Engaging stakeholders proactively enhances credibility. Organisations can use third-party platforms to provide updates and invite feedback, ensuring that financial activities meet both internal and external expectations. Enhanced transparency builds strong, long-term relationships with stakeholders.

Conclusion: Advancing Sustainable Finance in the Middle East and GCC

The Middle East and GCC have made significant strides in sustainable finance, driven by national goals and proactive climate commitments. Implementing a sustainable finance framework rooted in ICMA and LMA principles provides a solid foundation, and advanced practices help experienced organisations achieve greater impact. Through these frameworks, the region can continue supporting climate transition goals and fostering a sustainable economic future.

At Sustainable Square, we specialise in helping organisations develop and implement sustainable finance frameworks aligned with ICMA and LMA principles. Whether you’re looking to issue green bonds, sustainability-linked sukuks, or navigate ESG integration in your financial strategy, we provide expert guidance to ensure compliance and long-term sustainability.

Reach out to us at info@sustainablesquare.com for consultation and support in driving your sustainable finance initiatives forward.