Investing with Impact: Navigating the ESG Landscape in Private Equity

Inspired by France’s “loi de vigilance” and Germany’s Supply Chain Sourcing Obligations Act (LkSG), the directive aims to address issues such as child labor, slavery, labor exploitation, pollution, and biodiversity loss.

The surge in ESG-centered investing is gaining momentum, driven by concerns about economic sustainability, climate change, and human survival, as well as its returns. A study by MSCI found that companies with strong ESG ratings outperformed their counterparts by 3.1% annually over a 10-year period. Analysis of investment studies reveals a positive correlation between ESG and financial performance, leading to improved risk-adjusted returns for ESG investments. It’s estimated that by 2025, ESG-mandated assets will reach $53 trillion, representing one-third of global assets under management, according to Bloomberg Intelligence.

Funds and their portfolio companies are intensifying their public-facing ESG frameworks and commitments throughout their investment lifecycle. However, businesses lacking mature ESG capabilities during critical transactions like mergers, acquisitions, divestitures, and initial public offerings face higher risks of reduced valuations or deal failures due to perceived ESG risks. To ensure fair valuations and returns, it’s essential for dealmakers to proactively identify and mitigate potential ESG risks. Nonetheless, creating a framework to monitor portfolio company ESG risks and opportunities in real-time remains a significant challenge, compounded by the lack of standardised ESG reporting metrics and key performance indicators.

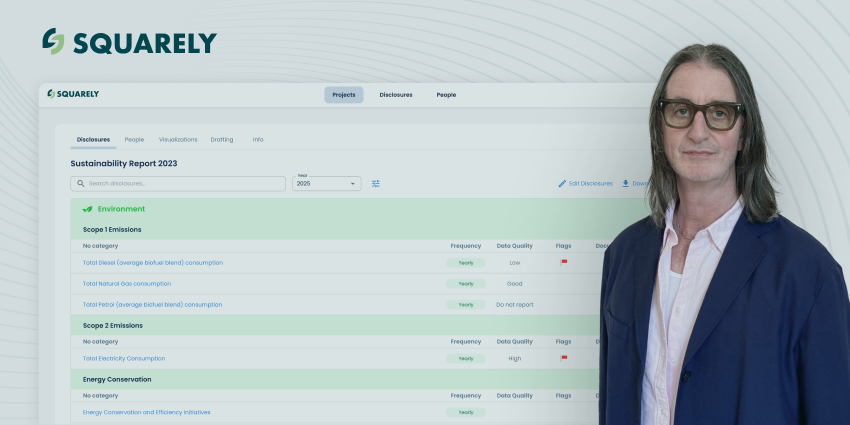

Technology enablement in ESG governance

Technology-based enablers can significantly enhance an organisation’s ESG governance risk and control landscape if they improve existing capabilities. To extract value from technology, it’s crucial to define technical and business requirements. If in-house expertise is lacking, external support for vendor selection and tool implementation management is advisable. User training is essential to quickly adapt personnel to changes and support them throughout the transition.

The concept of double materiality assessment

A double materiality assessment evaluates both the impact of sustainability risks on a company’s finances and the effect of the company’s activities on society and the environment. This assessment is vital for future planning, risk management, and accountability, providing essential information for strategic decision-making. However, conducting a comprehensive double materiality assessment can be resource-intensive and requires specific expertise. Companies may lack the necessary resources or prefer to allocate them to core business functions. Integrating the outcomes of a double materiality assessment into existing business strategies and risk management processes poses a challenge for many organisations.

Transition risks in the journey to sustainability

The transition to a sustainable future involves significant challenges, requiring major shifts in consumption patterns, product design, manufacturing processes, and consumer behaviour. For example, transitioning to a low-carbon economy carries the potential for large-scale job losses and economic impacts for communities and markets reliant on fossil fuels. It also necessitates the adoption of new technologies, processes, and regulatory frameworks, which may have unforeseen consequences. Keeping consumers informed and educated about the benefits of sustainable choices is essential for driving change.

The Role of Risk Managers in the Transition

Risk managers play a pivotal role in guiding organisations toward their sustainability goals and managing associated risks. They facilitate discussions around risk and opportunity, bridging gaps between internal and external stakeholders. As companies and their boards grapple with the risk implications of sustainability, finding ways to control and mitigate these risks is crucial. Collaboration is key to managing the risks and developing solutions for the transition to sustainability.

Building a resilient future through ESG and private equity

The integration of ESG principles into private equity investment strategies represents a significant shift in the financial landscape, highlighting the growing importance of sustainable practices in business. By embracing ESG considerations, private equity can play a crucial role in fostering sustainable growth, mitigating risks, and unlocking long-term value. As the intersection of ESG and private equity continues to evolve, it will shape a more resilient and sustainable future for businesses and society at large.